|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

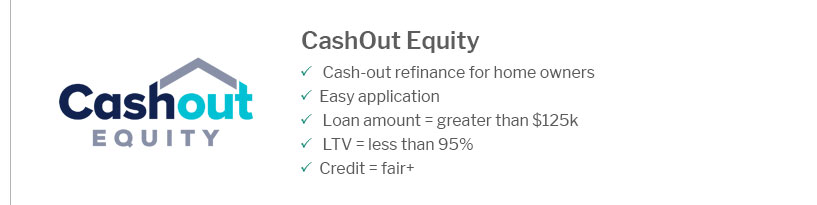

Understanding a Good Home Equity Loan Rate: What You Need to KnowHome equity loans can be an excellent financial tool, but securing a good home equity loan rate is crucial to maximizing their benefits. In this guide, we'll explore what makes a home equity loan rate favorable and how you can find the best one for your needs. Factors Influencing Home Equity Loan RatesSeveral factors can affect the interest rates on home equity loans. Understanding these can help you secure a better rate. Credit ScoreYour credit score is one of the most significant factors lenders consider. A higher score can lead to more favorable rates. Loan-to-Value RatioThe loan-to-value (LTV) ratio is the amount of your loan compared to your home's appraised value. Lower ratios can result in better rates. Market ConditionsInterest rates fluctuate based on broader economic conditions. Staying informed about current 15 year mortgage rates can provide insights into potential shifts in home equity loan rates. Pros and Cons of Home Equity LoansWeighing the pros and cons can help determine if a home equity loan is right for you. Advantages

Disadvantages

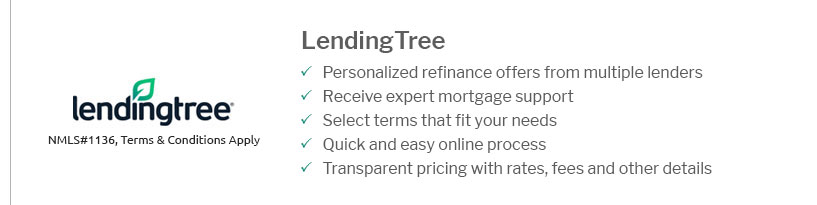

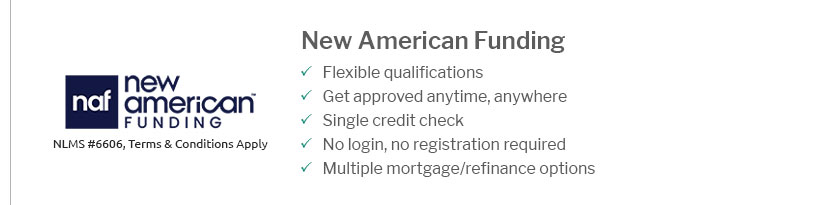

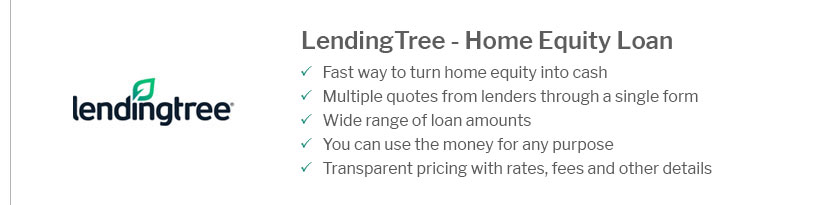

How to Secure a Good RateSecuring a good rate requires preparation and research. Improve Your CreditWork on improving your credit score by paying bills on time and reducing outstanding debt. Shop AroundCompare offers from multiple lenders to find the most competitive rates. Keeping an eye on trends like ten year mortgage refinance rates can be helpful. NegotiateDon’t hesitate to negotiate terms with lenders. They may be willing to offer better rates to secure your business. Frequently Asked Questions

https://homeequity.lmcu.org/

Home Equity Line of Credit (HELOC) ; Variable-Rate - 15 20 Years - Revolving Credit - 7.24%APR - No application and no annual fees. https://www.wsj.com/buyside/personal-finance/mortgage/home-equity-loan-rates

As of March 19, 2025, the average home equity loan rate is 8.37%, according to Bankrate's regular survey of rates. The average range is between ... https://www.cnet.com/personal-finance/home-equity/home-equity-loan-rates/

KeyBank - APR: From 9.59% (0.25% client discount included) - Max LTV ratio: 80% for standard home equity loans, 90% for high-value home equity ...

|

|---|